A New Era of Gold Ownership: Enhancing Authenticity and Liquidity through Digital Innovation

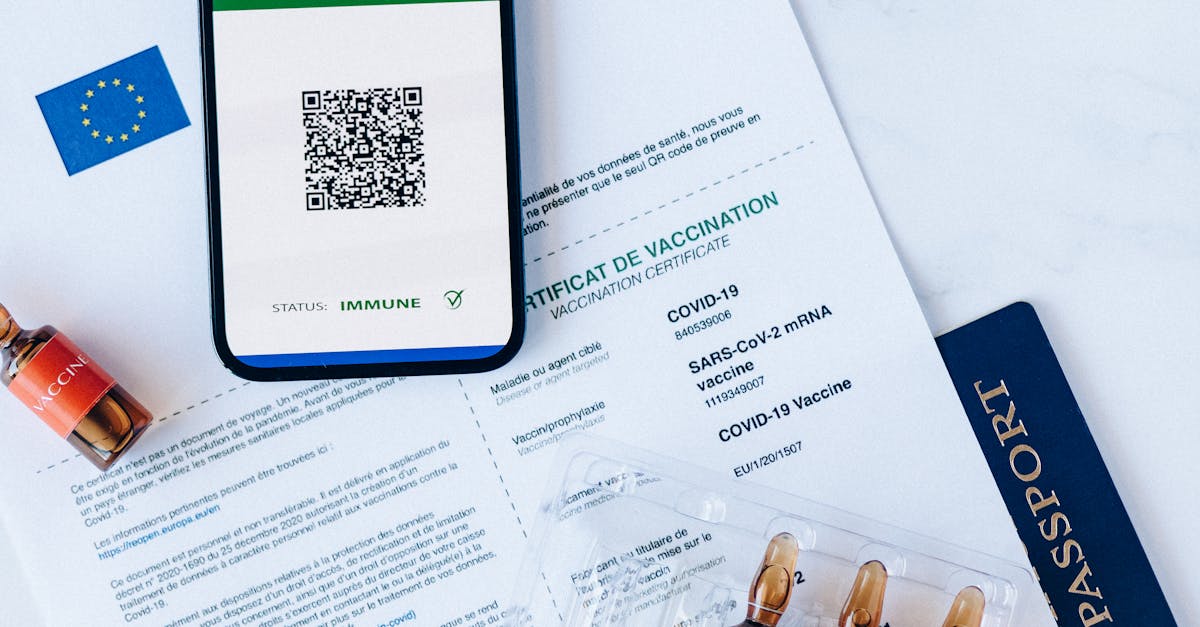

Digital certificates and non-fungible tokens (NFTs) are revolutionizing the gold market and introducing a new era of authentication and ownership. Digital certificates provide a tamper-proof digital seal of authenticity for gold ownership, while NFTs offer a unique way to represent fractional ownership and enhance liquidity. Together, these technologies are enhancing trust, reducing fraud, and increasing accessibility in the gold market.

The underlying foundation of digital certificates and NFTs is blockchain technology, which ensures the immutability and security of these digital assets. Blockchain’s decentralized and transparent nature fosters trust, allowing investors to verify the authenticity and ownership of gold holdings. Moreover, the use of digital certificates and NFTs streamlines the process of investing in gold, making it more accessible and convenient for a wider range of investors.

As the gold market continues to embrace digital innovation, the adoption of digital certificates and NFTs is expected to accelerate, further transforming the industry. This evolution will bring forth new opportunities, enhance market efficiency, and provide investors with greater confidence when investing in gold. Stay connected as we delve deeper into the world of digital certificates and NFTs, exploring their transformative impact on the gold market.

Key Insights

-

Digital certificates and NFTs are revolutionizing the gold market by providing secure and verifiable proof of ownership.

-

Blockchain technology underpins the security and immutability of digital certificates and NFTs, fostering trust in the gold market.

-

Digital certificates and NFTs offer tangible benefits such as increased transparency, reduced fraud, and enhanced accessibility in gold trading.

-

The adoption of digital certificates and NFTs in the gold market is gaining momentum, with industry players implementing innovative use cases and adoption strategies.

-

Investors can confidently invest in gold by understanding the different ways to invest, choosing reputable platforms, and considering their investment goals.

1. Digital Certificates: A Digital Seal of Authenticity

Digital certificates are revolutionizing the gold market by providing a secure and tamper-proof way to authenticate gold ownership. These digital certificates are issued by trusted third parties and contain essential information about the gold, such as its weight, purity, and ownership history.

The significance of digital certificates in the gold market cannot be overstated. They provide irrefutable proof of gold ownership and eliminate the risk of fraud and counterfeiting. Unlike traditional paper certificates, digital certificates are stored securely on a blockchain, ensuring their immutability and accessibility. This enhanced security and transparency build trust among market participants and investors, promoting confidence in the gold market.

For investors, digital certificates offer a convenient and efficient way to manage their gold holdings. They eliminate the need for physical storage and transportation, reducing associated risks and costs. Moreover, digital certificates simplify the process of buying, selling, and transferring gold, enhancing liquidity and accessibility in the market. As the gold market continues to embrace digital innovation, the adoption of digital certificates is expected to accelerate, transforming the industry and providing investors with greater peace of mind.

2. Non-Fungible Tokens (NFTs): Revolutionizing Gold Ownership

Non-fungible tokens (NFTs) are revolutionizing the world of gold ownership, introducing a new era of fractional investments and enhanced liquidity. Unlike traditional gold investments, which require ownership of physical gold, NFTs represent digital certificates of ownership for specific gold bars or allocated accounts.

The significance of NFTs in the gold market lies in their ability to fractionalize gold ownership. With NFTs, investors can purchase a fraction of a gold bar, making gold investments more accessible to a wider range of individuals. This fractional ownership opens up new opportunities for investors to diversify their portfolios and gain exposure to gold without the high costs associated with purchasing physical gold.

Furthermore, NFTs enhance liquidity in the gold market. Traditional gold investments can be illiquid, requiring time and effort to buy and sell physical gold. NFTs, on the other hand, can be easily traded on digital marketplaces, providing investors with greater flexibility and the ability to react quickly to market conditions. As the gold market continues to embrace digital innovation, the adoption of NFTs is expected to accelerate, transforming the industry and providing investors with greater opportunities and liquidity.

3. Blockchain Technology: The Foundation of Trust

Blockchain technology serves as the foundation of trust in the gold market, underpinning the security and immutability of digital certificates and NFTs. Blockchain is a decentralized and distributed ledger system that records transactions in a secure and transparent manner.

In the context of the gold market, blockchain technology plays a crucial role in ensuring the authenticity and ownership of gold. Digital certificates and NFTs are stored on the blockchain, creating an immutable record of ownership. This eliminates the risk of counterfeiting and fraud, as any attempt to tamper with the blockchain would be immediately detected and rejected by the network.

Moreover, blockchain technology promotes transparency and accountability in the gold market. All transactions recorded on the blockchain are visible to all participants, fostering trust and confidence among market players. This transparency also enables investors to track the provenance of their gold, ensuring its ethical sourcing and responsible production. As the gold market continues to embrace digital innovation, the adoption of blockchain technology is expected to accelerate, transforming the industry and providing investors with greater assurance and peace of mind.

4. Benefits of Digital Certificates and NFTs in the Gold Market

Digital certificates and NFTs offer a myriad of tangible benefits that are revolutionizing the gold market. These technologies enhance transparency, reduce fraud, and increase accessibility, creating a more secure and efficient market for all participants.

Firstly, digital certificates and NFTs promote transparency by providing a secure and immutable record of ownership. This transparency fosters trust among market participants and investors, as they can be assured of the authenticity and provenance of the gold they are trading. The elimination of intermediaries and the reduction of paperwork streamline the交易流程, further enhancing transparency and accountability.

Secondly, digital certificates and NFTs significantly reduce the risk of fraud and counterfeiting in the gold market. The secure and tamper-proof nature of these technologies makes it virtually impossible to counterfeit or alter digital certificates and NFTs, providing investors with peace of mind and protecting their investments. This reduction in fraud not only safeguards investors but also contributes to the overall stability and integrity of the gold market.

Finally, digital certificates and NFTs enhance accessibility in the gold market by making gold investments more accessible to a wider range of individuals. Fractional ownership through NFTs allows investors to purchase smaller portions of gold, lowering the barriers to entry and enabling greater participation in the market. Furthermore, the ease of trading digital certificates and NFTs on digital marketplaces provides investors with greater flexibility and liquidity, making it easier to buy, sell, and manage their gold holdings.

5. Adoption and Implementation: Real-World Applications

The adoption and implementation of digital certificates and NFTs in the gold market are gaining significant momentum, with various industry players embracing these technologies to enhance their operations and service offerings. Here are some notable use cases and adoption strategies:

-

Gold Bullion International (GBI), a leading gold trading and storage firm, has partnered with the blockchain company, Provenance, to issue digital certificates for its gold bars. These certificates provide investors with secure and immutable proof of ownership and allow for real-time tracking of the gold’s movement and storage.

-

The Perth Mint, one of the largest government-owned mints in the world, has launched a digital gold ownership platform that utilizes NFTs to represent fractional ownership of physical gold bars. This platform provides investors with greater accessibility to gold investments and enables them to easily buy, sell, and manage their gold holdings.

-

Several gold mining companies are exploring the use of blockchain technology to track the provenance and ethical sourcing of their gold. By implementing digital certificates and NFTs, these companies can provide investors with assurance that their gold investments are ethically and responsibly produced.

These adoption strategies highlight the practical implementation of digital certificates and NFTs in the gold market, showcasing their ability to enhance transparency, security, and accessibility. As the gold market continues to evolve, the adoption of these technologies is expected to accelerate, further transforming the industry and providing investors with greater confidence and opportunities.

6. Future Prospects: Digital Innovation in Gold Trading

The future of gold trading is inextricably linked to the advancements of digital innovation. As technology continues to reshape the financial landscape, we can anticipate several emerging trends that will shape the gold market:

-

Increased tokenization of gold: The tokenization of gold through NFTs and other digital assets will become more prevalent, enabling fractional ownership, enhanced liquidity, and new investment opportunities in the gold market.

-

Integration with decentralized finance (DeFi): The interoperability of gold-backed digital assets with DeFi platforms will open up new possibilities for lending, borrowing, and trading gold in a decentralized and transparent manner.

-

Adoption of smart contracts: Smart contracts will play a significant role in automating the execution and settlement of gold transactions, reducing counterparty risk and increasing efficiency in the gold trading process.

These future trends point towards a more digital and innovative gold market. As technology continues to evolve, we can expect further advancements that will enhance the security, accessibility, and liquidity of gold investments.

7. Investing in Gold with Confidence: A Guide for Investors

Investing in gold can be a wise decision for those seeking to diversify their portfolio and hedge against market volatility. Digital certificates and NFTs are revolutionizing the gold market, providing investors with new opportunities and greater confidence. Here’s a guide to help you invest in gold with confidence:

1. Understand the different ways to invest in gold: You can invest in gold through physical gold, gold ETFs, or gold-backed digital assets like digital certificates and NFTs. Each option has its own advantages and risks, so it’s important to research and choose the one that best suits your investment goals.

2. Choose a reputable platform: When investing in gold-backed digital assets, it’s crucial to choose a reputable platform that adheres to industry best practices for security and transparency. Look for platforms that provide clear information about the underlying gold backing and the terms of ownership.

3. Consider your investment goals: Determine your investment horizon and risk tolerance before investing in gold. Digital certificates and NFTs offer varying levels of liquidity and flexibility, so choose the option that aligns with your investment strategy.

By following these steps, investors can navigate the gold market with confidence and make informed decisions that align with their financial objectives.

What are the benefits of using digital certificates and NFTs in gold trading?

Digital certificates and NFTs offer several benefits in gold trading, including increased transparency, reduced fraud, enhanced accessibility, fractional ownership, and greater liquidity.

How do digital certificates and NFTs ensure the authenticity of gold ownership?

Digital certificates and NFTs are stored on a secure and immutable blockchain, providing a tamper-proof record of ownership. This eliminates the risk of counterfeiting and fraud, ensuring the authenticity and provenance of the gold.

How can investors leverage digital certificates and NFTs to invest in gold?

Investors can purchase digital certificates or NFTs that represent ownership of physical gold or gold allocated in vaults. These digital assets can be traded on digital marketplaces, providing greater flexibility and liquidity compared to traditional gold investments.

What are some reputable platforms for investing in gold-backed digital assets?

It is important to choose reputable platforms that adhere to industry best practices for security and transparency. Some examples include Paxos, Vaulted, and DGX.

How can I assess the liquidity of gold-backed digital assets?

The liquidity of gold-backed digital assets can vary depending on the platform and the underlying gold holdings. Investors should research the trading volume and market depth of the digital asset before investing.

Table of Key Insights

| Key Insight | Description | |—|—| | Digital Certificates and NFTs Enhance Authenticity and Ownership | Digital certificates and NFTs provide a secure and tamper-proof way to authenticate gold ownership, eliminating the risk of fraud and counterfeiting. | | Blockchain Technology Underpins Trust | Blockchain technology ensures the immutability and security of digital certificates and NFTs, fostering trust and transparency in the gold market. | | Tangible Benefits of Digital Certificates and NFTs | Digital certificates and NFTs offer tangible benefits, including increased transparency, reduced fraud, and enhanced accessibility in gold trading. | | Adoption and Implementation Gaining Momentum | The adoption of digital certificates and NFTs in the gold market is gaining significant traction, with industry players implementing innovative use cases and adoption strategies. | | Confident Gold Investment | Investors can invest in gold with confidence by understanding the different investment options, choosing reputable platforms, and aligning their investments with their financial objectives. |